1864 Fund |Top 1% Performance | Led by Operators, Not Tourists

The 1864 Fund is Actively Raising

Join a top 1% seed stage performance fund. Our track record of 27 investments since 2021 – with 3.34x MOIC and 30% DPI puts us 264% above the benchmark and in the top 1%.

Our Focus

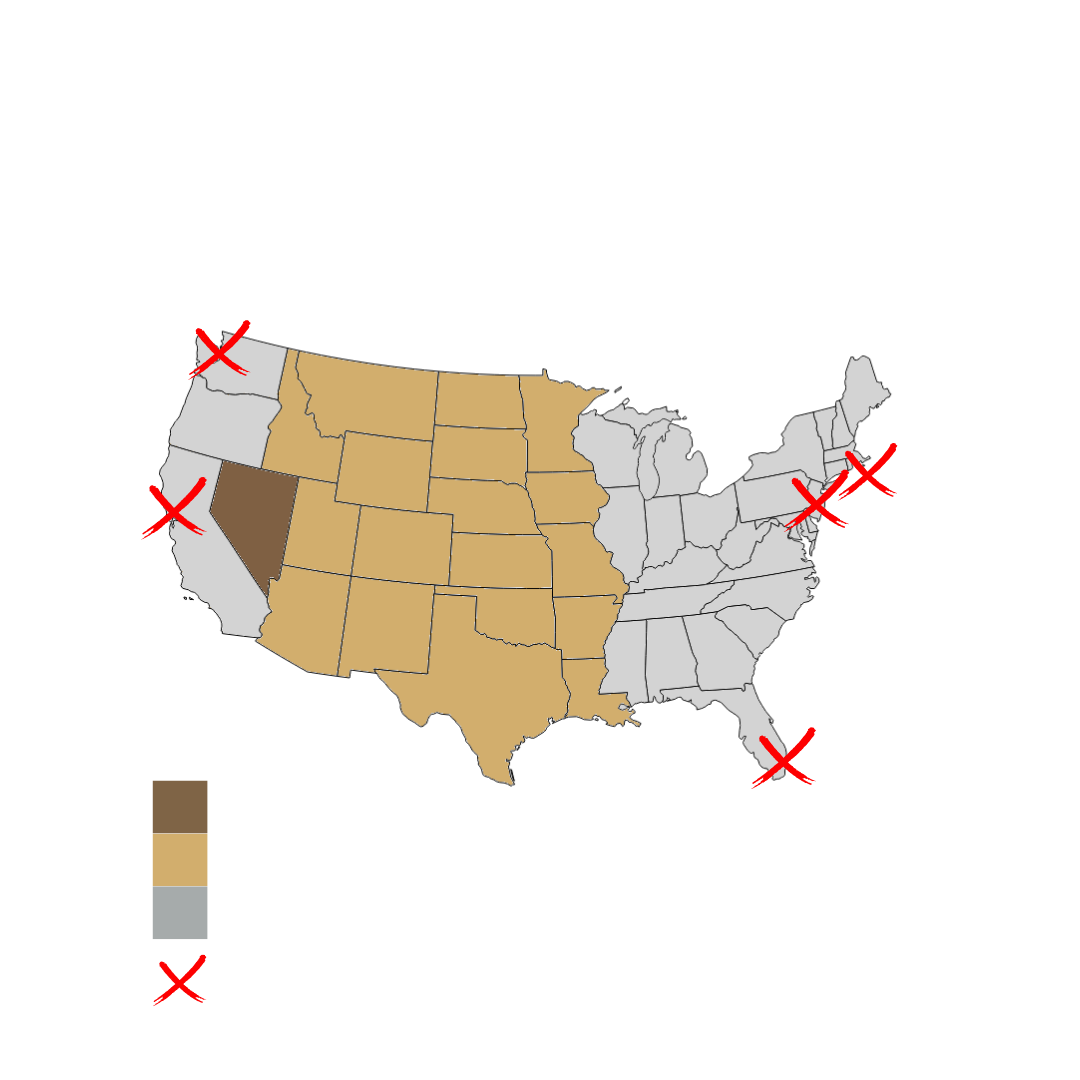

We believe that value and talent found outside of traditional venture enclaves (California, Massachusetts, New York) present an exceptional return opportunity absent provincial exuberance.

We like to lead deals in the “gold zone” and syndicate with partners all other regions except “no go” metros, where deals tend to be overpriced.

Stage

We lead or participate in seed rounds across sectors as clear-sighted supporters of companies with pragmatic value propositions and exceptional teams.

Goal

We drive opportunistic returns while making an impact in the communities we serve through economic development, diversification, and resiliency.

Business

Capital efficient companies addressing outsized market opportunities with technology driven competitive advantages.

How We Invest

- Lead fund checks $1M+ (fund + LP SPVs)

- Seed Rounds $1M -$2.5M, depending on valuation

- Achievable exit scenarios returning 50x per investment (2X fund size)

- The deal has a realistic and reasonable valuation supported by the company’s progress and industry exit comparables.

- Lead where appropriate, with board seat and neutral board

- Every opportunity QSBS qualified

- Target 1864 ownership: 5-10%, deal dependent (as part of round size for 15%-20%, valuation target in mid-seven figures)

- “Dream Deal”: $2M round with $10M valuation for a company in a large market with founders who can execute and current run rate of $500k in annual recurring sales, growing at 3x or more annually.

Why Invest?

- Portfolio diversification independent from traditional equity or fixed income investments

- Exclusive LP access to follow-on SPV investments to concentrate capital into portfolio winners

- Nevada investments matched 1:1 by the State of Nevada through SSBCI funding

- Resources and capital for entrepreneurs, investor education, and economic development in the American West

1864 Partners | Operators, not Tourists

Spanning the Boomer, GenX, and Millennial generations, our partners are operators with seven successful exits, an eye for driven founders with scalable startups in large markets, and the discipline to invest at the right entry valuation with win-win terms.

Jeff Saling

Piotr Tomasik

Steve Hurst

Leith Martin

Are you a founder looking for funding?

Unlock the Capital You Need to Grow

Raising capital is a consistent challenge. Don’t face it alone. The 1864 Fund provides capital and experience to help find product-market fit and scale. Please complete this form for consideration for funding.

About

As a $10M seed-stage fund, the 1864 Fund is affiliated with the StartUpNV accelerator and mentor programs, supporting early-stage companies and founders – going well beyond providing capital. 1864 is based in Las Vegas and invests regionally. Our lead checks are between $1M and $2.5M in seed rounds from $1M to $10M. Our syndicate multiplies our investment in follow-on rounds. Access the world through our Las Vegas based fund – everyone comes to town multiple times per year. Visit with us next time you’re here.